what to expect: a basic explanation of the oil market in the context of Venezuela

In the beginning of January, we saw the president of Venezuela and his wife captured and brought to the US on drug trafficking.

Trump announced that US oil companies will rebuild the oil industry in Venezuela. In Trump’s words at a news conference “they were pumping almost nothing by comparison to what they could have been pumping” and “we are going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure.”

So what does this mean?

According to the U.S. Energy Information Administration, Venezuela has 303 billion barrels of oil reserves, the largest oil reserve in the world (2024). Chevron is the only U.S. oil company with active operations there. Trump said the US oil companies will pay directly for the rebuilding of crude infrastructure, and will be reimbursed (Kimball 2026).

The History

In 1976, Venezuela nationalized its oil industry. This resulted in the president at the time, Hugo Chavez, seizing assets from International companies to create state-owned Petróleo de Venezuela S.A. (PDVSA). Exxon and Conoco have billions of dollars in outstanding claims against Caracas from these moves (Kimball 2026). In Trump’s words it was one of the “largest thefts of American property.” It is alleged that Conoco is owed $10 billion and Exxon is owed around $2 billion (Kimball 2026).

In the 1990s Venezuela produced 3.5 million barrels per day, with production today being at 800,000 barrels (Kimball 2026).

In “The United States’ Aspirations for Venezuela’s Oil” on the Daily, they discuss the subject of the oil being “rightfully” owed to the US, the sentiment that is seen throughout US media and the Trump administration. The expert, Anatoly Kurmanaev dove into the oil industry in Venezuela, which took off in the 1920s. When the oil industry boomed in Venezuela, American Oil workers moved for work, creating a culture that blended America and Venezuela. “American” towns began to emerge, that grew into cities that resembled American way of life. Alongside this, America invested capital, as Venezuela became the largest exporter in the world. This oil wealth built up the country’s infrastructure. With the presence of major corporations, citizens began to realize how much of their countries profit went to foreign entities.

This drove the rise of “resource nationalism.” This concept was that natural resources belong to the citizens of the state, and the wealth belongs to them. Leaders ran for office appealing to voters with this idea.

OPEC was then formed, in large part to leaders in Venezuela, an entity that provides co-operation and alignment of the largest players in oil. The Organization of the Petroleum Exporting Countries (OPEC) involve the largest oil-producing and oil-dependent countries, including Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela when it began in 1960. Today, it has 12 countries. The idea behind OPEC was agreeing on the amount of barrels produced, which would impact supply. This supply allowed for somewhat control over prices, which would impact the countries profit.

After this first wave of nationalism, in the 80s, the price of a barrel of oil went down. Venezuela’s economy was so dependent on oil, that this caused the economy to struggle. After this was a period of “oil opening” policy. This welcomed foreign investment into the country, and reversed nationalization efforts.

However, this effort was short lived. In 1999, Hugo Chavez became president of Venezuela. In 2002, Chavez replaced oil executives with political allies with limited experience. This resulted in employees being dismissed after strikes broke out and the oil production dropping. Chavez worked against the “oil opening,” and forced companies to give up control of the projects.

Following Chavez’s death, in 2014, Venezuela entered a “pro-longed period of economic decline” (Kurmanaev 2026). Delcy Rodriguez, the now interim president, was tasked with turning the economy around. She was the minister of economy and finance, and has had significant improvements since she began.

In 2022, Biden’s administration issued a license that allowed for a joint venture between Chevron and the PDVSA for oil. Later, in July 2025, the current administration granted a restricted license, allowing production but banning proceeds from going to Maduro’s government.

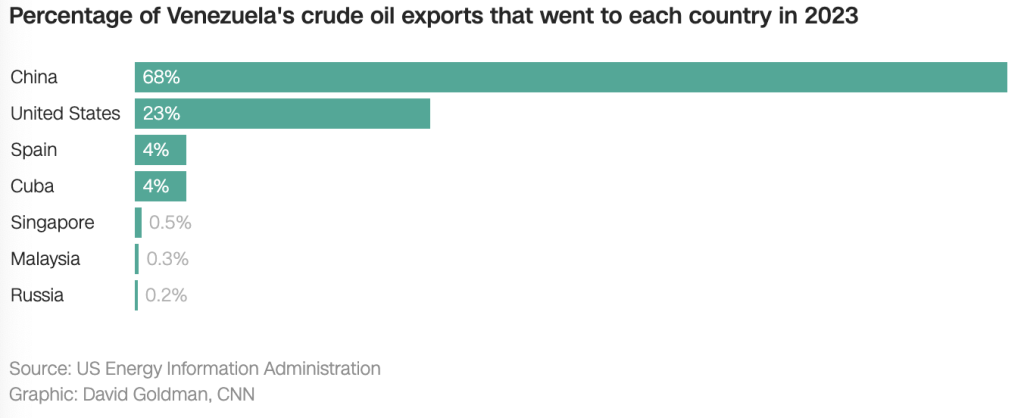

Below is a graph provided in David Goldman’s for CNN:

China and Russia both participate in Venezuela’s oil exchange. In November 2025, there was a 15-year extension of a joint-venture with Russian-linked companies with operations there (Kimball 2026).

The Market

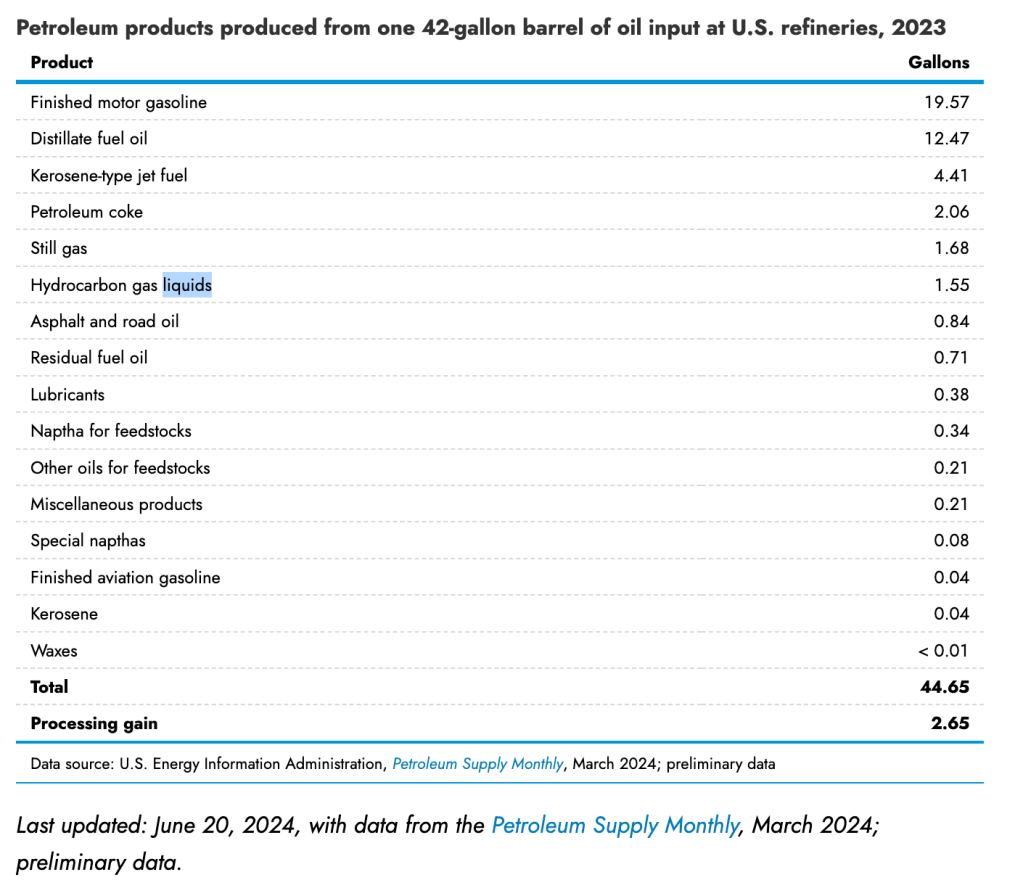

Oil is a commodity, often time you hear in business the “commodities market.” These are raw materials used to create products. Oil is used for many products which are created at different points in the refining process. Refining, is the breaking down of crude oil into various parts, which can then be used for products. Oil is used in gas that fuels our vehicles and heats homes and businesses. From the U.S. Energy Information Administration, in 2023, the US consumed on average 20.25 million barrels of petroleum per day (petroleum is a term that encompasses both crude oil and petroleum products). Most crude oil is produced or imported and then refined into petroleum products, gasoline, diesel, heating oil, and jet fuel.

Commodity markets are more than just trading resources. The market has contracts for trading, which created commodity futures exchanges. This allows commodity producers to hedge, or avoid, risk that comes from price fluctuations (risk). This risk from price changes, gets sold or passed to others in the economy. The asset class has evolved over time, and has mutual funds, ETFs, notes, and other ways to participate in the market.

The current oil market has growing supply and weak demand. The larger economy has struggled with inflation and affordability, contributing to the fallen demand. By making Venezuela a bigger supply of oil, western oil companies could produce and use more. This aligns with the priorities of US businesses, specifically, big tech in the United States. With the massive energy demanded for AI infrastructure, people are scratching their heads over how to fuel these projects.

Lower prices however disincentivize US oil companies from further production. In the world of economics, incentives are important to understand human (and corporate) behavior. What will incentivize US companies to start doing business in Venezuela again? According to CNN, the PDVSA (Venezuelan state-owned oil and natural gas company), says its pipelines have not been updated in 50 years (Goldman 2026). With an estimated price tag of $58 billion to return to past levels of production (Goldman 2026).

As of Sunday January 11th, the price of oil is $59.12 per barrel. The price went above $60 a barrel when oil was siezed from the US, but then fell to $57.

There is a current embargo, an official ban on trade or commercial activity with Venezuela. With talks of the first oil tanker coming to the United States in the cming weeks.

The Oil

The reserves are located in the Orinoco belt and are heavy crude oil that requires a lot of effort to use. One analogy discussed by Mark Zandi and Ed Elson “What Venezuela’s Regime Change Means for Oil”, was how oil has a spectrum of good to bad. If the good oil was champage, the bad was like coffee grounds. The crude oil would be described on the end of the spectrum like coffee grounds, that requires companies to extract, refine, and then use the oil through technical and advanced processes. Before this happens, there are negotiations to how US companies will approach re-entering the oil businesses there.

The actual production is 0.8% of global crude production, at 1 million barrels a day (Goldman 2026). Before the current regime, as previously discussed this is a decline from when the country produced 3.5 million barrels a day. During this decline, the country saw international sanctions and an economic crisis that furthered its impact, on top of the lack of attention and investment.

The United States is the largest oil producer. The oil produced in the US is important for gasoline. The heavy oil that is Venezuela has is used for diesel, asphalt, and fuels for factories (Goldman 2026). Diesel has been in “tight supply around the world” largely because of previous sanctions on Venezuelan oil (Goldman 2026).

Looking Forward

Before moving operations back to the country, it is expected that U.S. producers will seek to recover claims of the oil seized back in the 1990s. Chevron is poised for growth, with a resource base already there and joint ventures with the PDVSA. Being apart of 23% of the nation’s output.

Investors sent the shares of Chevron, Exxon Mobil, and ConocoPhillips up, the three largest U.S. oil companies. The market was bullish on the news, also with companies that help service oil, Slb, Halliburton, and Baker Hughers shares ending up.

The turmoil of the country could prevent any production, however the current administration is pushing US oil companies to participate. In the newsletter sent out from the New York Times on January 9th, Trump sat down with oil executives and said that he expects at least $100 billion to rebuilt the oil infrastructure in Venezuela. Executives expressed their reservations and uncertainty with the stability of the nation, even using the term “uninvestable”. The interim government are working to establish diplomacy with the United States and potentially open back up the US embassy there.

In Venezuela, there are armed groups, political loyalists to Maduro, as well as political adversaries. Rodriguez is under pressure of maintaining a stable rule of law and ensuring political stability. If this were to be achieved, the United States would gain a major source of oil production, driving oil prices down. This would potentially lower the cost of products, addressing the affordability crisis in the US. However like previously mentioned, this lies on the incentives of major corporation to participate. The production furthers Americas geopolitical power with oil, specifically with China and Russia.

It will be interesting on what is to come with Venezuela and the oil market.

Works Cited

While the media is in a frenzy, there have been some great discussions on the Daily Show done by Michael Barbaro and Prof G Markets with Ed Elson. This sparked my interest and inspired this work.

Kurmanaev A., & Abrams, R. (Hosts). (2026, January 13). The United States’ Aspirations for Venezuela’s Oil [Audio podcast episode]. The Daily. Spotify. https://open.spotify.com/episode/632QIC2DC1KxoWSFyuelnO

Goldman, D. (2026, January 3). Trump says U.S. is taking control of Venezuela’s oil reserves and recruiting American companies to refurbish its oil industry. CNN Business. https://www.cnn.com/2026/01/03/business/oil-gas-venezuela-maduro

Kimball, S. (2026, Jan 3). Trump says U.S. oil companies will invest billions of dollars in Venezuela after Maduro’s overthrow. CNBC. https://www.cnbc.com/2026/01/03/trump-venezuela-oil.html

Galloway, S., & Elson, E. (Hosts). (2026, January 6). What Venezuela’s regime change means for oil [Audio podcast episode]. In Prof G Markets. Prof G Media. https://open.spotify.com/episode/2ojrVz6ZkcJ4nMfk3WicLa

McDaniel, W. (2025, June 11). Everyday products & uses [Fact sheet]. Colorado Oil & Gas Association. https://www.coga.org/factsheets/everyday-products-uses

PIMCO. (n.d.). Understanding commodities. PIMCO. Retrieved January 13, 2026, from https://www.pimco.com/us/en/resources/education/understanding-commodities

U.S. Energy Information Administration. (2024, February 8). Country analysis brief: Venezuela (PDF). U.S. Department of Energy. https://www.eia.gov/international/content/analysis/countries_long/Venezuela/pdf/venezuela_2024.pdf

U.S. Energy Information Administration. (2024, October 9). How much oil is consumed in the United States? U.S. Energy Information Administration. https://www.eia.gov/tools/faqs/faq.php?id=33&t=6

U.S. Energy Information Administration. (2024, June 20). Refining crude oil — Inputs and outputs. U.S. Energy Information Administration. https://www.eia.gov/energyexplained/oil-and-petroleum-products/refining-crude-oil-inputs-and-outputs.php

The New York Times. (2026, January 9). Live Updates: Trump meets with oil executives at White House; Venezuela projects unity after Maduro’s ouster [Live blog]. The New York Times. Retrieved January 13, 2026, from https://archive.vn/2026.01.09-224841/https://www.nytimes.com/live/2026/01/09/world/venezuela-trump-us?campaign_id=57&emc=edit_ne_20260109&instance_id=169076&nl=the-evening®i_id=175283365&segment_id=213443&user_id=cbf90162b8a099514002781c865b5201

Leave a comment